I have this morning published the next in my series of proposals that will make up the Taxing Wealth Report 2024.

In this latest note, I consider the need to reform the rate at which inheritance tax is charged. I suggest that one of the biggest reasons for the unpopularity of this tax is that the 40% flat rate used once an estate falls within the scope of the charge to this tax appears to be a very blunt instrument.

What I suggest is required are progressive rates of tax, rising as the size of the states increases, with the overall aim of making this tax considerably more progressive rather than to necessarily raise additional revenue. The latter objective may, however, be achieved if the other recommendations made with regard to inheritance tax in the Taxing Wealth Report 2024 were adopted.

As the summary of the note says:

Brief Summary

This note proposes that:

- The rates at which inheritance tax is charged should be subject to review.

- The existing flat charge rate of this tax is inappropriate and might be one reason for its lack of political acceptability.

- The current charge structure of this tax also fails to deliver sufficient vertical tax equity within this tax.

- At the same time, that flat rate also results in insufficient wealth being redistributed by this tax when that is one of the objectives for using it.

- If new tax rates from 10 per cent to 60 per cent of the value of chargeable estates were introduced on cumulatively increasingly wide bands of chargeable estate, then whilst no additional tax might necessarily be collected the distribution of that charge would change considerably, with much more being paid by higher value estates.

- The suggested revised structure would reduce the inheritance tax due on almost all chargeable estates of less than £1 million, often by significant amounts.

- When this issue has been addressed, and when other recommendations in the Taxing Wealth Report 2024 relating to this tax have been considered, it may be appropriate to reconsider the size of the nil rate band for this tax.

Discussion

As I suggest in the note:

It has long been the case that the structure of inheritance tax has been overdue for reform.

The nil rate band for this tax, which takes the vast majority of UK estates out of a charge to inheritance tax, has been set at £325,000 since 2009, although this sum can be increased in the case of the passing of former domestic residences. This sum is not expected to change until at least 2027.

The rate of tax has been subject to even less change. A few exceptions apart, once inheritance tax is charged it has been due at 40% for decades. It is stressed, that this rate only applies to the chargeable estate above the nil rate band, and not to the estate in its entirety.

For a tax that is so unpopular, according to public reports, the fact that there has been no serious review of its structure or rates for more than a decade is surprising. The changes that have been made have all tinkered at the edges of the tax, but not addressed issues of principle.

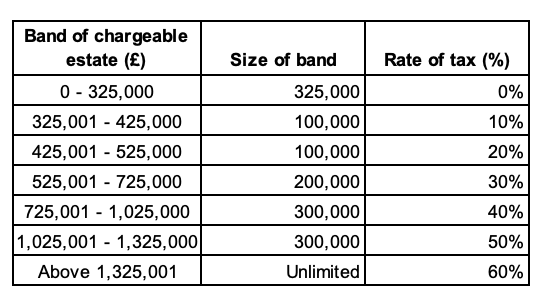

There are almost countless ways in which changes to the rates of inheritance tax could be made. I have not sought to model them all. I have, instead, opted for a relatively simple reform, which is to keep the nil rate band as it is at present, but to then introduce progressive tax rates thereafter, as follows:

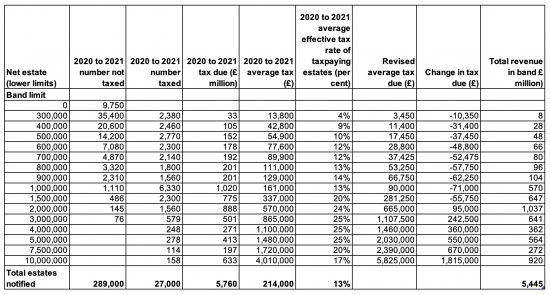

This would change liabilities by band as follows:

As I suggest in the note:

As will be noted, for many smaller estates, where the imposition of this tax is most keenly felt, liabilities would fall if these bands were adopted.

This would also be true for all estates where the overall net estate is less than £1.5 million.

However, on higher value estates the overall liability increases, as it would also do if other recommendations in the Taxing Wealth Report 2024, e.g. with regard to agricultural and business property relief are also taken into account, given that most of the estates claiming those relief will fall into this category.

It is suggested that this overall redistribution of liabilities is just and equitable whilst also achieving the goal of redistributing wealth within the UK without imposing tax charges at rates that are uncommon within the rest of the economy.

It will be noted that this change is broadly tax neutral. Bands could be altered to achieve an increase in revenue raised. Those chosen here were instead picked to increase the degree of redistribution that the tax might achieve.

Sometimes taxing wealth better is about achieving social goals and not raising revenue. This suggestion is a case in point.

Cumulative value of recommendations made

The recommendations now made as part of the Taxing Wealth Report 2024 would, taking this latest proposal into account, raise total additional tax revenues of approximately £105.2 billion per annum.