The Taxing Wealth Report 2024 seeks to answer the question that every journalist loves to ask of every politician, which is ‘how are you going to pay for it?’, whatever 'it' might be.

What we know is that all our leading political parties, and Labour most especially, are acting as if they still believe Liam Byrne’s claim, made in 2010, that ‘there is no money left’.

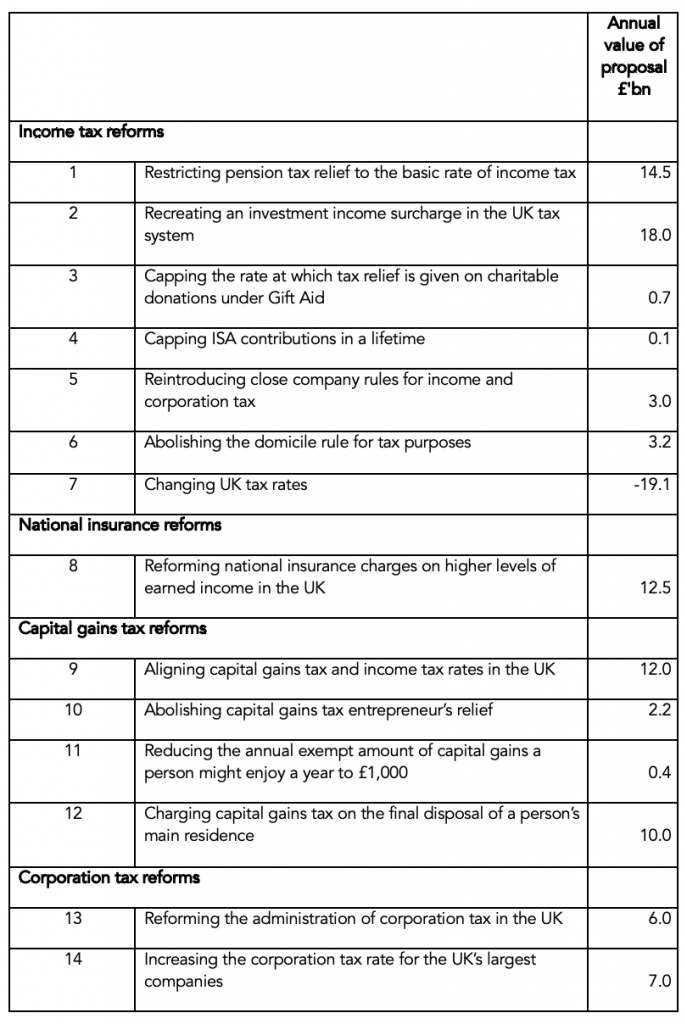

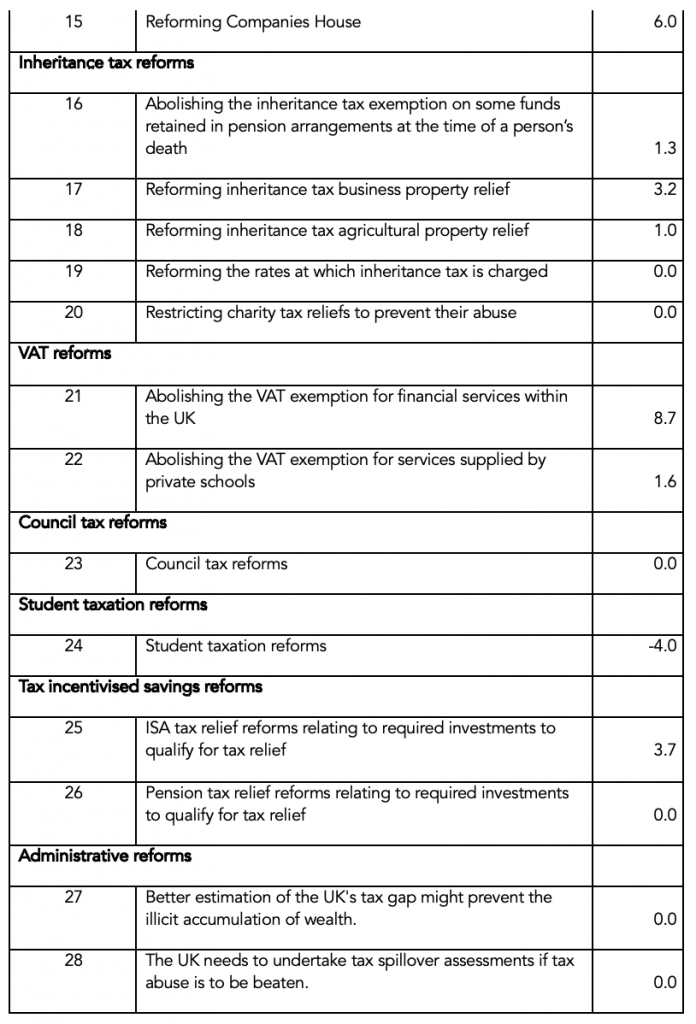

The Taxing Wealth Report shows that by making up to thirty relatively simple changes to existing UK taxes, up to £90 billion of new tax revenue could be raised a year, entirely from those who are well off or who are straightforwardly wealthy. Only those in the top 10% of income earners should be affected.

A summary of the proposals made in the report is available here.

Some of the suggestions made, and the amounts that they might raise in additional tax, are as follows:

1) Charging capital gains to tax at the same rate as income tax would raise £12 billion of extra tax per annum.

2) Restricting the rate of tax relief on pensions to the basic rate of income tax, whatever tax rate a person pays, would raise £14.5 billion of extra tax per annum.

3) Charging VAT on the supply of financial services, which are inevitably consumed by the best off, could raise £8.7 bn of extra tax per annum.

4) Charging an investment income surcharge of 15% on income earned from interest, dividends, rents, and other sources might raise £18 bn of extra tax per annum. Lower rates could, of course, be charged. This estimate assumes no such charge on the first £5,000 of such income a year, with a higher allowance for pensioners.

5) Charging national insurance at the same rate on all earned income, whatever its amount above the existing minimum, might raise up to £12.5 bn of extra tax per annum.

6) Investing £1 billion in HMRC so that it might collect all tax owing by the UK’s 5 million or so companies when 30% of that sum goes unpaid at present might raise £12 billion per annum.

In addition, the report suggests that if the tax incentives for saving in ISAs and pensions were changed so that all new ISA funds and 25% of all new pension contributions were required to be saved in ways that might help fund new infrastructure projects in the UK, including those linked to climate change, then up to £100 billion of funds might be made available for that purpose a year.

The great fear amongst many people in the UK at present is that Labour might form a new government this year but will not change anything because of their commitment to harsh fiscal rules that appear to promise more austerity. The Taxing Wealth Report 2024 shows that this austerity is not necessary. The existing tax system only needs to be made a bit fairer and the funding required to transform our society would be available.

Download the report

The report is available in three lengths (click to download the version you want):

Happy reading.

Links

Why wealth is seriously undertaxed in the UK

Summary of the proposals

The tax and savings impacts of the recommendations made in the Taxing Wealth Report 2024 are as follows: