I posted this thread on Twitter this morning to explain the launch of the Taxing Wealth Report 2024:

Everywhere you look there is reason for the UK government to spend more money. Health, schools, water, transport, housing and energy. But the government and Labour say there is no money left. That, I suggest, is simply not true. A thread…..

The case for more government spending is obvious. The money to pay for it comes from three sources: borrowing, money creation (or QE) and taxation. If inflation is to be controlled, tax has to be in that mix.

So, if the government says there is no new money to cover the cost of spending then what it is really saying is tax is at the limit of what is possible. But it very clearly is not. There is ample room for more tax in the UK, but it would all have to be paid by the wealthy.

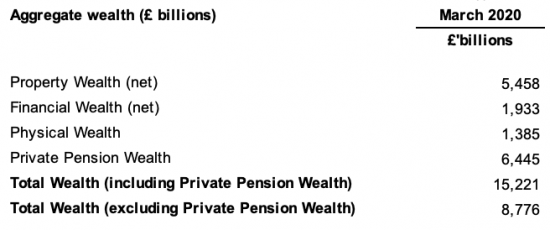

There was more than £15 trillion of wealth in the UK in 2020 according to the Office for National Statistics. That's the most recent available estimate.

That wealth is broken down like this:

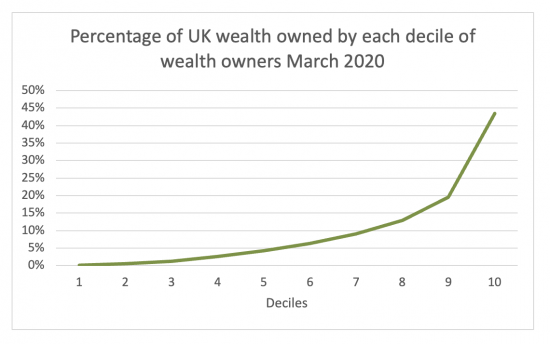

The split of ownership of wealth in the UK is deeply unequal. It looks like this:

43.5% of total wealth is owned by the top 10% of people. The top 20% of wealth owners have 63% - or almost two-thirds – of UK wealth between them. The bottom half of the population has just 8.7% of all wealth in the UK. There is extraordinary wealth inequality in the UK.

This inequality is also getting worse. Between 2011 and 2020 (the period between the global financial crisis and Covid) total national income averaged £1,753 billion a year. Increases in wealth averaged £592 billion a year. Wealth increases were equivalent to one-third of national income in this period – and most of that went to not very many people.

That increase in financial well-being was also massively undertaxed. On average, income was taxed at 32.9% in this period. Increases in wealth were, on the other hand, taxed at 4.1%. Less than 4% of all tax was paid on wealth even though wealth increases contributed 25% of the total increase in financial wellbeing during this period.

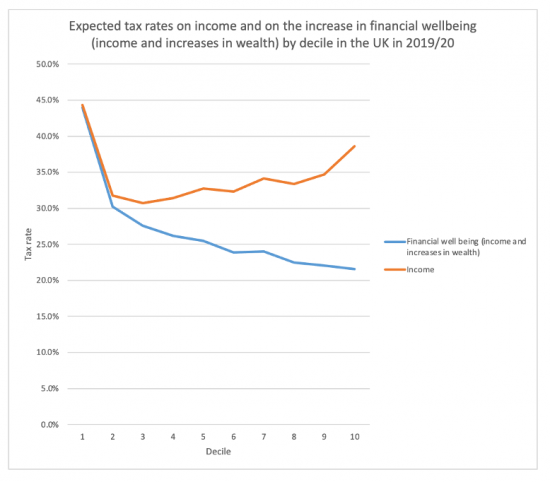

Put this tax data together with data on who are the most likely people to own wealth and you get the following chart on the likely tax rates paid by each decile of income earners in the UK over this period:

The lowest ten per cent of income earners pay tax at 44.3% on their incomes. The wealthiest pay at 38.6%. But when increases in wealth are taken into account these rates change to 44% and 21.5%, respectively. The wealthy do as a result pay tax at half the rate of the least well-off.

Overall, if the wealthiest people in the UK had paid tax at the same percentage on their incomes and increases in wealth between 2011 and 2020 as people paid on their incomes alone then £170 billion more tax could have been raised in the UK each year.

In that case it is impossible to argue that there is no scope to raise new tax revenue in the UK. There very obviously is, albeit only from the wealthy.

It is also impossible to say that “there is no money left” as some politicians have done this summer. There are vast amounts of money left. It's just that the wealthy have got it, and they're notoriously unkeen on sharing it.

It is also untrue that there is nothing a politician can do to fund more public spending at present when it is glaringly obvious that the means to raise more tax on those with high incomes and wealth very clearly exists.

How do I know all this? Because this summer I have built on this data and have identified around thirty ways to raise more tax in the UK, all of it from the wealthiest in our society. Over the next few weeks, I will be publishing all those suggestions.

Don't get me wrong though. I am not saying we should raise £170 billion in new taxes. That's because I am not sure that the government could spend that much.

Nor am I saying that I want a wealth tax, whether one-off, as the TUC has suggested, or annually as others propose.

Wealth taxes would:

- Take a long time to introduce

- Create massive problems with asset valuations

- Result in very large numbers of tax disputes with wealthy taxpayers

- Be very expensive to collect.

Those are big problems, and I want results now.

Thankfully there are many more efficient and fairer ways to tax the richest in society and the wealthy more if we really want to raise the taxes that are needed to prevent inflation when the government spends as much as is really going to be needed, very soon.

My thirty proposals cover all our biggest taxes:

- Income tax

- National insurance

- Capital gains tax

- Corporation tax

- Council tax

- Value added tax

I also look a the administration of tax – because there is no point in having new tax laws if there is no way to collect the money owing, which is a problem the UK has had for a long time.

And all of this is before new taxes are considered - which may also be necessary, but in due course.

Some of these proposals are already well-known, obvious and overdue. Many will not be so obvious to most people. What they all share in common is the fact that they are possible now.

Put together, the proposals could raise many tens of billions in tax a year - depending on how many are adopted and what tax rates are chosen. But what is clear is that the amount in question is much more than could reliably be raised from any wealth tax.

The whole series of recommendations will be published on my blog over the next few weeks and will then become a book. There will also be a website. Today, I have introduced the series, here.

I have also explained how I worked out that the wealthy are undertaxed by £170 billion, here. There's more than 20 pages to that one, but these claims need to be justified.

I have also published the first proposal - which is to cut the rate of tax relief on the pension savings made by the wealthiest people from the 45% or 40% relief they get right now to the 20% rate which is all that basic rate taxpayers get on their pension contributions.

Like everything I suggest, this change is fair. There is no reason why the wealthy deserve more tax relief on their savings than those on lower incomes get.

This change is also fair because at present the average (I stress, average) wealthy person gets an average of £8,750 of pension tax relief a year when the state old age pension is £10,600 a year. That cannot be right.

This one simple, fair and easy-to-introduce tax change could raise, with associated national insurance savings, maybe £14.5 billion a year in extra tax revenues.

And before any higher rate taxpayer objects, the average higher rate taxpayer will still enjoy tax relief on their pension of more than five times the average relief paid given to a basic rate taxpayer each year. The system will still be horribly biased, even after this change.

This highlights the key issues that I am making when presenting these proposals. These are:

- The tax system is very biased to favour the wealthy

- This could be changed

- Making those changes could raise considerable sums in tax

- The required decision to do that is political

Perhaps just as importantly, the decision to not raise tax when, as I show, that can be done in a fair way, is also political. If that tax is not raised the politicians deciding not to do so making must think that the wealthy need money more than the country does.

It is for people to decide whether politicians get that decision right. But over the next few weeks my aim is to show that it would be possible to raise all the money required to sort out the mess that this country is in.

My aim is to inform debate by showing that the tax that is needed by our government is available to it. That fact should be known. Then the politicians will have to justify themselves. I want them to do just that when it comes to tax.